How to Spot and Analyze Cryptocurrency Trends

How to Spot and Analyze Cryptocurrency Trends

Introduction

Cryptocurrencies have become a hot topic in recent years, with many investors looking to profit from their volatility. However, one of the key challenges faced by cryptocurrency enthusiasts is identifying and analyzing trends in this rapidly changing market. In this blog post, we will discuss some useful tips and techniques to help you spot and analyze cryptocurrency trends effectively.

Understanding Cryptocurrency Trends

1. What are cryptocurrency trends?

Cryptocurrency trends refer to the patterns and movements in the prices and market behavior of various digital currencies, such as Bitcoin, Ethereum, and Litecoin. By identifying and analyzing these trends, investors can make informed decisions about when to buy, sell, or hold cryptocurrencies.

2. Why is it important to spot and analyze cryptocurrency trends?

Cryptocurrency markets are highly volatile and can experience rapid price changes. Spotting and analyzing trends can provide valuable insights into market sentiment and future price movements. This information can help investors make strategic decisions and maximize their returns.

Spotting Cryptocurrency Trends

1. Conducting Technical Analysis

Technical analysis involves studying historical price charts and using various indicators to identify trends. Key indicators may include moving averages, relative strength index (RSI), and MACD (Moving Average Convergence Divergence). By analyzing these data points, you can identify potential trend reversals or continue following existing trends.

2. Monitoring Market Sentiment

Market sentiment plays a crucial role in cryptocurrency trends. By monitoring news, social media discussions, and market reports, you can gauge the overall sentiment surrounding a particular cryptocurrency. Positive sentiment can indicate an upward trend, while negative sentiment may suggest a downward trend.

Analyzing Cryptocurrency Trends

1. Minimizing Noise with Moving Averages

Moving averages can help smooth out short-term price fluctuations, making it easier to identify long-term trends. For example, a 50-day moving average can provide a clearer picture of the overall trend by averaging out the prices of the past 50 days.

2. Using Volume Analysis

Volume analysis refers to studying the trading volume associated with a cryptocurrency. High trading volume during an uptrend indicates strong buying pressure, while high volume during a downtrend suggests more selling activity. Analyzing volume can provide insights into the strength of a trend or potential reversals.

Frequently Asked Questions (FAQs)

1. How often should I analyze cryptocurrency trends?

The frequency of analyzing cryptocurrency trends depends on your trading strategy and investment goals. Some traders analyze trends daily, while others may prefer a longer-term approach. It is essential to stay updated on market developments and adjust your analysis accordingly.

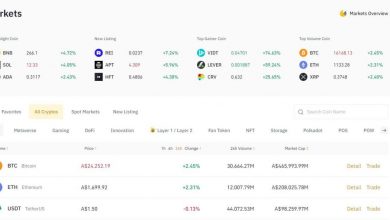

2. Are there any reliable tools for cryptocurrency trend analysis?

Yes, there are several tools available that can assist you in analyzing cryptocurrency trends. Some popular options include TradingView, CoinMarketCap, and CoinGecko. These platforms provide a range of technical indicators, price charts, and market sentiment analysis to help you make informed decisions.

3. Can I predict cryptocurrency trends with 100% accuracy?

No, predicting cryptocurrency trends with absolute accuracy is nearly impossible. The market is influenced by various factors, and unexpected events can lead to sudden price fluctuations. However, by utilizing technical analysis, monitoring market sentiment, and staying informed, you can increase your chances of making profitable trading decisions.

Conclusion

Spotting and analyzing cryptocurrency trends is essential for any investor seeking to navigate the volatile world of cryptocurrencies successfully. By applying technical analysis, monitoring market sentiment, and using reliable tools, you can gain valuable insights into market trends and make informed trading decisions. Remember to stay updated, be adaptable, and practice risk management to maximize your profits in this ever-evolving space.